As a regular office worker with a modest salary in the UK, I can’t exactly save millions or invest in swanky properties. Instead, I’ve embraced a “boring” investment strategy that I believe will pay off in the long run.

My plan is to maximize the £20k ISA allowance each year. Here’s the breakdown: 40% goes into funds, another 40% into high-dividend stocks, and the remaining 20% into high-risk stocks with the hope of a nice uptick in stock price. Naturally, all dividends will be reinvested to harness the magic of compounding.

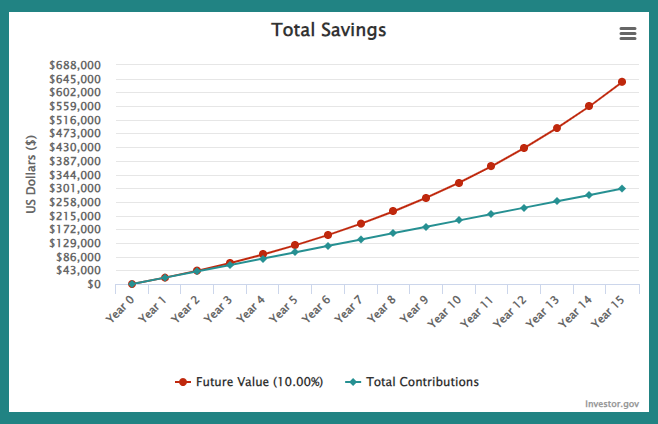

Now, let’s talk numbers. With a yearly interest rate of 10%, my investments should compound to a tidy £318,000 in 10 years. Stretch that out to 15 years, and we’re looking at a cool £635,000. The goal? In 15 years, I hope to live off the dividends from my stock portfolio.

So, while I may not be sipping champagne in a penthouse anytime soon, I’m confident that my “boring” strategy will lead to financial freedom. After all, who needs fancy properties when you can have the satisfaction of a well-compounded ISA? Cheers to that! 🍾📈

Stay tuned for more riveting tales of financial prudence and dry British humour. 😉

Compounding effect, I know it says USD and not GBP, but the idea is the same.

Leave a Reply